The actions that meet the golden rule of quadruplica in 20 years

- Laura de la Quintana

- Cristina Cándido

¿Dónde quiero estar dentro de 10 años? ¿Cómo visualizo mi futuro, mi familia o mi trabajo en una década? Son preguntas que todo ciudadano se ha planteado alguna vez. Se busca fijar un objetivo y hacer todo lo que sea necesario para alcanzarlo. En el mundo de la inversión sucede lo mismo. Más allá del ruido cortoplacista, por norma general el inversor busca crear una cartera de valores a largo plazo a la que se le debe exigir, como mínimo, un 7% anualizado.

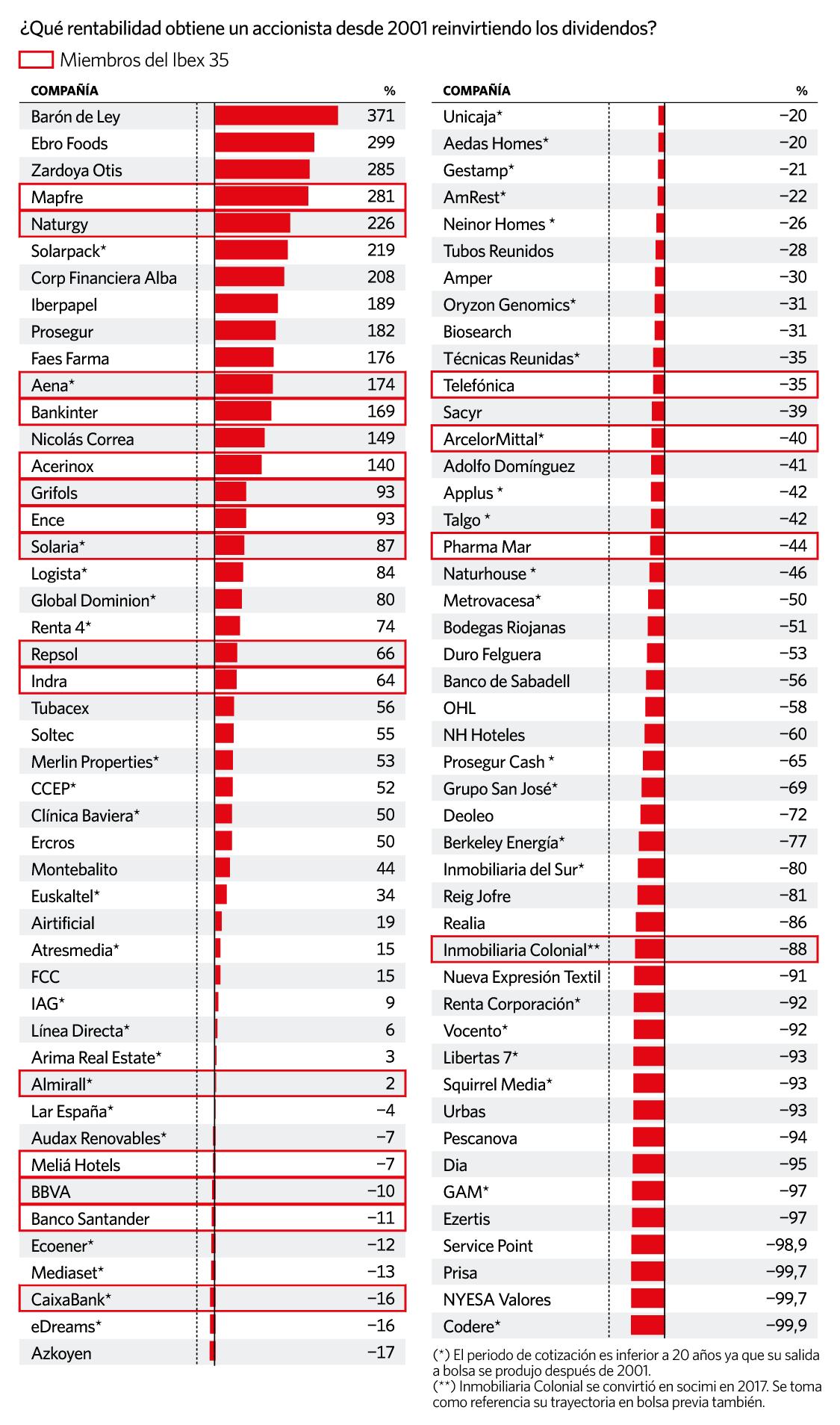

La teoría financiera más clásica habla de esta cifra mágica como retorno absoluto para los inversores en renta variable en un largo periodo de tiempo y el S&P 500 así lo corrobora.In the last 20 years it offers an annual profitability of 7.8%. Desde elEconomista hemos realizado un ejercicio algo más exigente y se ha seleccionado solo a aquellas compañías que hayan logrado doblar la inversión en diez años y cuadriplicarla en los últimos 20.In the calculation the remuneration to the shareholder has also been taken into account and includes the reinvestment of the dividends collected. ¿El resultado? 26 firmas de la bolsa española logran este objetivo, de las que 14 pertenecen actualmente al Ibex 35 y las restantes son pequeños valores, tradicionalmente joyas de las carteras de los gestores value nacionales.

How do they comply with the annualized 7% rule?In his favor he plays what is known in finance as a compound interest, which is a concept as simple as used among investors. ¿En qué consiste? Si un inversor compró 100 euros en acciones de Telefónica en el año 1 y recibe un dividendo de 10 euros que decide no cobrar y sí reinvertir, su nominal inicial será de 110 euros en el año 2 y llegará a duplicar hasta 200 euros cuando arranque el undécimo ejercicio.This implies that if the action is revalued 7% annually the difference between reinvesting the dividend or not doing so is increasingly enlarging.Who pays metallic payments will have managed to fold their investment in a decade, with a 104% revaluation.Who reinverts them will obtain a revaluation of 204% on the initial investment, up to 304 euros in the tenth year (in addition to the fiscal savings it supposes).

This is what also happens with the Ibex with dividends versus the traditional selective. El primero se encuentra a un alza del 6,5% de volver a tocar máximos históricos (que encuentra en los 29.439 puntos), mientras que el Ibex 35 está casi un 80% de subida de volver a coronar los 16.000 points of the pre-lehman era.

Hay nueve compañías que superan una revalorización del 1.000% en las últimas dos décadas, incluyendo reinversión de dividendos: se trata de CIE Automotive (la mejor de todas ellas, con una revalorización del 3.209%), followed by Vidrala (2.827%), Prim (2.527%), Grenergy Renewables (2.241%), Viscofan (1.913%), CAF (1.719%), Electric Red (1.427%), Catalana Occidente (1.073%) and Airbus (1.013%), according to Bloomberg.Inditex and Grifols stay at the gates of being part of this group with 997% and 976%, respectively.

Cie Automotive was one of those value companies that emerged in the portfolio of the fund managers and that, once in the Ibex, has given its seat to its younger brother, Global Dominion, who from his Ipart% revaluation. Si en lugar de reinvertir los dividendos, el inversor hubiera optado por cobrarlos, igualmente, lograría pingües ganancias del 2.667%.CIE is quoted in 2018 maximum zone, thanks to the 15% rally that mark their shares since it presented results in October.

Vidrala is another example of value creation for the shareholder.The Basque firm, world leader in manufacturing glass containers, is one of the most uprisers of recent years with increases in 3.000% in the last 20 years without taking into account dividends. Tiene un valor en bolsa que supera los 2.500 millones de euros, más que cuatro de las integrantes actuales del Ibex 35 (Solaria, Pharma Mar, Meliá e Indra), pero a pesar de cumplir por capitalización, se mantiene fuera del índice a causa de su menor liquidez.

How to report to Kidnapping in Madrid?https: // t.CO/8GQFTSR8OP

— Zahraa. Wed May 26 00:28:29 +0000 2021

Menos conocida es la historia bursátil de Grupo Prim, aunque no por ello es menos rentable.The company, which develops, manufactures and distributes a wide range of orthopedic products, reached historical maximum August and shows profits including its 2 payments.527% in two decades.

Grenergy energy follows, although its history in the parquet is much shorter than the companies mentioned above. La firma de renovables que dirige Andrés Ruiz de Andrés debutó en el Mercado Alternativo Bursátil (MAB, actual BME Growth) en 2015 y dio el salto al Continuo en 2019, y brinda una rentabilidad del 2.241% the company at the moment does not distribute dividend.

Viscofan is another paradigmatic sample that throughout its 45 years of history has conjugated organic growth with the inorganic to become the undisputed leader of the wrappers for meat products in the world.Show this is that in a year as complicated as 2020 was one of the ones who best behaved for its defensive character. En estas dos décadas la firma que preside Domingo Ampuero brinda un 1.913%.

Le sigue CAF con un 1.719%, que en este periodo de tiempo ha crecido al calor de un mercado que se reparten unos pocos fabricantes de material rodante (ferrocarriles, autobuses, etc.) Worldwide.

El caso de Red Eléctrica, con una rentabilidad del 1.427% desde 2001 es también paradigmático teniendo en cuenta la visibilidad que la compañía ofrece sobre su política de retribución comprometida de cara a los próximos años: 1 euro bruto por título y año hasta 2022, lo que a precios actuales renta un 8,5%, la tercera rentabilidad por dividendo más alta de la bolsa española tras Atresmedia y Metrovacesa.Not including its payments, the utility revalued about 1.700% since 2001.However, from 2023 to 2025 it will reduce its payment to 0.8 euros, lowering its return to 4.5%.

How much do the 'Blue Chips' offer

Inditex is the firm that exemplifies the creation of value par excellence.It is the largest company for Ibex capitalization.In the 20 years of contribution (it was released in 2001) has reported profits to its shareholders of almost 1.000%, with reinvested dividends.His action was one step away from beating historical maximums until Friday's fall, which reached in 2017 at 32.78 euros.

The Galician textile, everything points to it, will leave the reinforced pandemic as long as its online sales branch has managed to remain in time despite the end of the confinements.At the end of the first semester of the year (from March to August) the income of its brands through the web pages grew 36% compared to the same period of 2020 when Spain, its first market, was literally closed throughout a quarter.The company has advanced a year that the sale online exceeds 25% of the total and at the end of 2021.The good management of the stock and the integration of the online and the physical channel will lead Inditex to return to Ebit margins of 17% and this exercise, and to exceed 18% in 2022, and it is something that has not happened since 2013.

Well below Inditex but without leaving Ibex, they triple their profitability with Mapfre and Naturgy dividends, with 281% and 221%, respectively, in the last 20 years and duplicate Bankinter and Acerinox, with 169% in the caseof the orange entity and 140% the ancer.Repsol follows them, which offers 66%.

In red numbers is the great bench of the Ibex.BBVA, Santander and CaixaBank go back in this period between 10% and 16%.Much greater is the descent of Telefónica and Arceormittal.The Teleco captained by Álvarez-Pallete shows losses of 35% despite considering that dividends are reinvested.As for the Luxembourg Acerera, the recoil is practically the same with and without its payments, and it is 40% since 2006, the year of its merger.

![47 best antiage nutritive cream in 2022 [based on 326 reviews] 47 best antiage nutritive cream in 2022 [based on 326 reviews]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_6/2022/2/27/1918fc37c66ad30564173e69d9df88a0.jpeg)