Colombians spent, on average, $179,000 on cosmetics during the pandemic

The pandemic, teleworking and, above all, the use of face masks put the cosmetic sector in the country in check, as annual per capita spending went from almost $200,000 on these products to $179,000 during 2020, which represented a drop of 9, 75%.

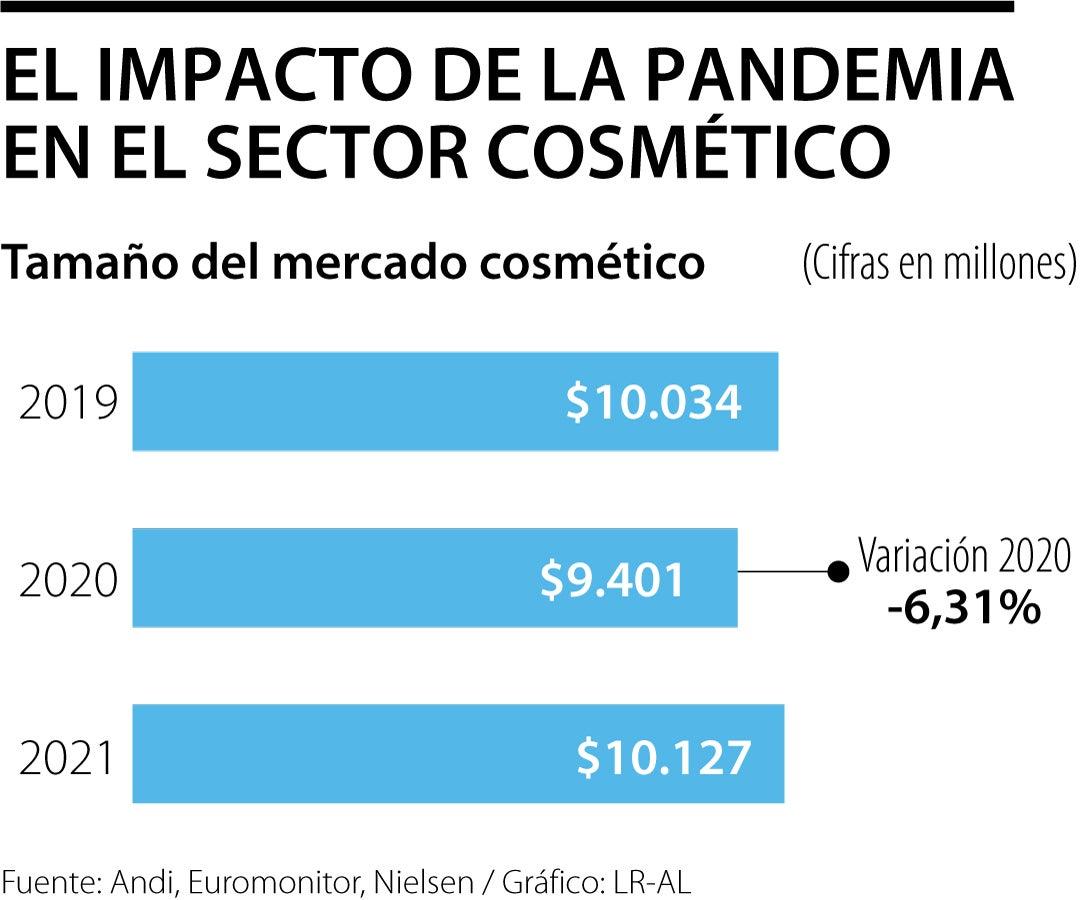

The market, in general, fell 6.3% compared to the 2019 figure according to Andi, however, the impact was different for each product. For example, in the makeup category, while products for lips or cheeks lagged behind, the sale of products for eyes took all the credit.

RELATED ARTICLEBardot Cosmetics turns 60 and wants 100% of its products to be vegan

“The sale of eye makeup has grown by more than 20%. In an environment with masks, the eyes became more protagonists than ever. The big loser of this pandemic, in the makeup category, is lipstick, the drop is widespread and greater than 30%, ”said José Miguel Rey, general manager of Cosméticos Bardot.

Figures from Scatrack, a recent Nielsen study, show that within the general market, sales of lipsticks fell by up to 52%; 47%, blushes; 46% powder and 41% foundation; with what the part of the face that covers the mask seems to have been left in the background for consumers, who now care about their look.

THE CONTRASTS

This has not only been seen by the brands, but also by the large platforms on which these products are offered, which would represent 39.9% of the distribution channels.

“Makeup is one of the categories that has fallen the most in the context of the pandemic, especially lip lines. We highlight, however, the behavior that eye products have had, above the rest of the product lines, possibly due to the use of face masks,” said Falabella Colombia.

@bullock_tom @IBMScience @Inspire_BMS Any tips on how to get to the trainee BMS stage? Currently doing BSc Biomedic… https://t.co/Xyc7MKJygR

— Vicky Brunning 💜🤍💚 Fri Jul 23 17:44:50 +0000 2021

This trend, precisely, would be an important element for the sector when it comes to boosting sales during 2021. The projection from Vogue's Mass Consumption Division is that the make-up market in Colombia reaches $345,000 million, which would represent 40% more than what was achieved in 2020, and a drop of 13% compared to 2019.

“During 2021 we expect our Vogue brand to lead the recovery of the category. We will encourage the consumption of eye makeup and nail products, which are the products most consumed by Colombian women during this time of pandemic. This year we will innovate with products that have followed the latest trends worldwide in terms of finishes, duration and look”, commented Carolina Mora, general director of the Vogue Mass Consumption Division.

RELATED ARTICLEThis is the opening protocol that hairdressers and beauty salons must follow

Other cosmetics that have increased their sales are hair care and skin care, which, according to Prosalon, could be the result of restrictions to go, for example , to beauty salons, which has encouraged users to use these products on your own.

"In all our business units, Cromantic, Blind stores and our distribution channel, we registered growth in home care products. Facial and hair treatments have stood out in this period with an average growth of 6%; others, such as hair straighteners, dyes and acne treatments, have presented a growth of 13%", added Prosalon.

Although the sector is optimistic about this year's outlook, and, for example, Euromonitor expects the market to increase to $2,672 million this year; The actors are still waiting for the handling of the pandemic.

“That these projections occur is not known, in reality there is no plan forward, we do not know how to project ourselves, because every day there is a new measure, a new strain, that is what we expected according to what was being projected in the last six months”, commented Juan Carlos Castro, executive director of the Andi Chamber of Cosmetics and Grooming.

Facing the panorama of exports, according to what this division of Andi collects, the figure reached US$385.4 million; which represented a drop of 12.10% compared to 2019.

The main exports were in Latin America, with Peru being the largest recipient with 23.9% of the total; Mexico, 18.6%; Ecuador, 17.9%; Chile, 9.2% and Costa Rica, 3.6%. The cosmetics category represented 60.84% of all exports of this Chamber, cleaning products, 19.81% and absorbent products, 19.35%.

Finally, the number of imports presented a drop of 9.39% during 2020, and reached US$364.2 million. The countries from which it imported the most were Mexico, 28%; United States, 14%; Brazil and Spain, 9% and China, 6%.

The most used distribution channels for the market According to figures from Euromonitor, last year 70.1% of cosmetic sales in the country were made through retail stores; category in which grocery stores are found, 51%, such as supermarkets or hypermarkets; and specialists, 17.1%, a category in which retail stores are found: drugstores, pharmacists, neighborhood stores or open-air markets. The other 29.6% of sales were made through other sales channels such as direct or online.

![46 Best Eyebrow Tint in 2022 [Based on 59 Expert Opinions]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_6/2022/2/27/ed118fdf3947d2023236cbe413ad9041.jpeg)

![47 best antiage nutritive cream in 2022 [based on 326 reviews] 47 best antiage nutritive cream in 2022 [based on 326 reviews]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_6/2022/2/27/1918fc37c66ad30564173e69d9df88a0.jpeg)